If you have ever wondered what is accounting and why it is considered the “language of business,” you are not alone. Many beginners feel intimidated by accounting terms, financial statements, and numbers, assuming the subject is only for finance professionals. In reality, accounting is a practical life skill that helps individuals and businesses track money, measure performance, and make smarter decisions.

At its core, accounting is about organizing financial information so it becomes useful. Whether you are running a startup, managing a shop, freelancing, or simply trying to understand your personal finances, accounting provides the structure to record transactions, analyze results, and plan for the future.

In this beginner-friendly guide, you will learn the true meaning of accounting, how it works step by step, the main types of accounting, real-world examples, advantages, limitations, and common mistakes to avoid. By the end, you will clearly understand how accounting supports transparency, control, and long-term success.

Understanding the Core Meaning of Accounting

To fully grasp what is accounting, it helps to move beyond textbook definitions and look at what accounting actually does in everyday life.

Accounting classifying, summarizing, analyzing, and communicating financial information. This information is mainly about money, where it comes from, where it goes, and what remains.

In practical terms, accounting answers questions such as:

- How much did the business earn this month?

- What expenses were incurred?

- Are we making a profit or a loss?

- How much do customers owe us?

- Can we afford to invest or expand?

Without accounting, financial activity becomes guesswork. With accounting, it becomes measurable, comparable, and manageable.

A simple example:

If you run a small bakery, accounting tracks daily sales, ingredient costs, staff wages, rent, taxes, and profits. Over time, these records reveal patterns of busy seasons, high-cost items, or declining margins allowing you to make informed changes.

Why Accounting Exists: Purpose and Practical Importance

The importance of accounting goes far beyond compliance or paperwork. Accounting exists because every financial decision needs evidence.

1. Decision-making support

Accounting data helps owners and managers decide whether to increase prices, cut costs, launch new products, or seek funding.

2. Financial control

By tracking every transaction, accounting prevents leakages, detects errors, and discourages fraud.

3. Performance measurement

Profit, cash flow, and asset growth all come from accounting records. Without them, performance cannot be measured accurately.

4. Legal and tax compliance

Governments require businesses to report income and expenses. Accounting ensures these reports are accurate and defensible.

5. Communication with stakeholders

Investors, lenders, and partners rely on accounting reports to evaluate risk and opportunity.

In short, accounting transforms financial chaos into financial clarity.

A Brief Evolution of Accounting (Mini Context)

Accounting is not a modern invention. Merchants in ancient Mesopotamia recorded transactions on clay tablets over 7,000 years ago. The double-entry system—still used today—was formalized in 1494 by Luca Pacioli, an Italian mathematician.

Since then, accounting has evolved with commerce. Today’s digital accounting tools automate calculations, but the underlying principles remain the same: accuracy, consistency, and transparency.

Understanding this history highlights that accounting is not just technical—it is foundational to trade, trust, and economic growth.

Accounting Basics for Beginners: Key Building Blocks

Before exploring the full process, beginners should understand the basic components that shape accounting systems.

Financial transactions

Any event involving money sales, purchases, payments, loans, investments—is a transaction.

Accounts

Transactions are grouped into accounts such as cash, inventory, revenue, expenses, assets, and liabilities.

Ledgers

A ledger is the complete collection of all accounts, showing every financial movement.

Financial statements

These summarize accounting information into structured reports such as income statements and balance sheets.

These elements work together to convert daily activities into meaningful financial insight.

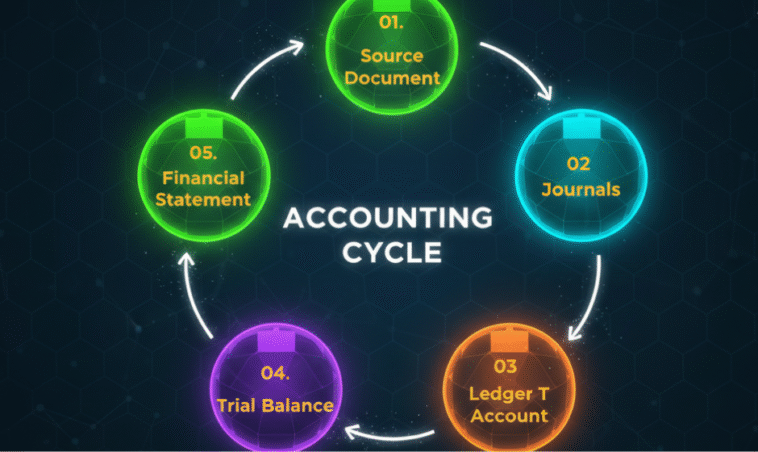

The Accounting Process Step by Step

To truly understand what is accounting, it is essential to see how it functions as a structured workflow rather than isolated tasks.

Step 1: Identifying financial transactions

The process begins by recognizing events that affect finances. Not every action is recorded only those that involve measurable monetary value.

Example:

Buying raw materials, receiving customer payments, paying electricity bills, or taking a bank loan.

Step 2: Recording transactions (Journalizing)

Each transaction is entered into a journal using the double-entry system, where every entry has a debit and a credit. This maintains balance and accuracy.

Micro case:

If a business buys equipment for $2,000 cash, equipment increases while cash decreases.

Step 3: Posting to the ledger

ledger. This shows the running balance of each account.

Step 4: Preparing a trial balance

All ledger balances are compiled into a trial balance to check whether total debits equal total credits.

This step detects mathematical errors before final reporting.

Step 5: Adjusting entries

Certain items such as depreciation, prepaid expenses, and accrued income are adjusted at the end of a period to reflect real economic conditions.

Step 6: Financial statements preparation

After adjustments, the main financial statements are created:

- Income statement

- Balance sheet

- Cash flow statement

Step 7: Closing entries

Temporary accounts like revenues and expenses are reset for the next accounting period.

This step-by-step structure ensures consistency, reliability, and comparability across time.

Major Types of Accounting Explained

When learners ask what is accounting, they often assume it is a single function. In practice, accounting includes multiple specialized branches.

Financial accounting

Managerial accounting

Supports internal management. It involves budgeting, cost analysis, forecasting, and performance measurement.

Cost accounting

Tracks production costs to help businesses price products and control expenses.

Tax accounting

Auditing

Examines accounting records to verify accuracy and reliability.

Forensic accounting

Investigates financial irregularities, disputes, and fraud cases.

Each type serves a unique purpose but relies on the same foundational principles.

Financial Accounting Fundamentals Every Beginner Should Know

Financial accounting revolves around three primary statements:

Income statement

Shows revenues, expenses, and profit over a specific period.

Balance sheet

Displays assets, liabilities, and owner’s equity at a particular point in time.

Cash flow statement

Tracks actual cash inflows and outflows.

Together, these reports answer three essential questions:

Is the business profitable?

What does it own and owe?

How is cash moving?

Quick calculation example:

If revenue is $10,000 and expenses are $7,500, profit equals $2,500. This simple equation is the heartbeat of financial accounting.

Accounting Principles and Core Concepts

Accounting systems operate under established principles to ensure fairness and consistency.

Accrual principle

Consistency principle

Methods should remain stable over time.

Prudence concept

Accountants avoid overstating income or assets.

Business entity concept

Business finances are separate from personal finances.

Going concern assumption

Accounts assume the business will continue operating.

These concepts may sound technical, but they protect the credibility of financial information.

Bookkeeping vs Accounting: Understanding the Difference

Many beginners confuse bookkeeping with accounting. Although related, they are not identical.

Bookkeeping focuses on recording transactions sales, purchases, receipts, and payments. Accounting goes further by interpreting, analyzing, summarizing, and reporting that information.

Think of bookkeeping as data collection and accounting as financial storytelling. Both are necessary, but accounting adds meaning to the numbers.

Real-World Applications of Accounting

Accounting is not limited to corporations. Its principles appear in everyday life.

Small businesses

Track sales, manage expenses, calculate taxes, and monitor growth.

Freelancers

Invoice clients, control cash flow, and prepare tax records.

Households

Budget monthly spending, plan savings, and manage debt.

Nonprofits

Demonstrate transparency to donors and regulators.

In each case, accounting builds financial awareness and discipline.

Benefits of Accounting in Modern Life

Understanding what is accounting also involves recognizing its advantages.

- Improves financial decision-making

- Enhances transparency and trust

- Supports long-term planning

- Enables cost control

- Strengthens business credibility

- Facilitates access to loans and investments

Accounting turns uncertainty into structured knowledge.

Limitations and Practical Constraints of Accounting

Despite its strengths, accounting has limitations.

Accounting relies on historical data, which may not predict future outcomes accurately. Estimates such as depreciation and provisions involve judgment, not certainty. Inflation can distort asset values. Human error and bias may affect records.

Recognizing these constraints prevents blind reliance on reports and encourages critical analysis.

Common Beginner Mistakes in Accounting

Beginners often struggle with similar issues.

- Mixing personal and business expenses

- Ignoring small transactions

- Poor documentation

- Inconsistent methods

- Delayed record-keeping

Micro case:

A small shop owner who records transactions weekly instead of daily may forget minor expenses, slowly distorting profitability figures.

Consistency and discipline are more valuable than complexity.

Practical Tips to Start Learning Accounting

If you are beginning your accounting journey, start simple.

Focus on understanding basic statements. Practice recording transactions. Use accounting software to automate calculations. Review monthly reports. Learn core principles before advanced topics.

Most importantly, connect accounting numbers to real activities. This transforms abstract figures into meaningful insights.

Mini Summary: What You Should Know So Far

Accounting is a structured system for tracking, analyzing, and communicating financial activity. It operates through a defined process, relies on recognized principles, and supports decision-making across all economic levels.

Understanding the basics equips you with a powerful tool to control resources, evaluate performance, and plan responsibly.

The Role of Accounting in Business Growth

As businesses expand, accounting evolves from simple record-keeping to strategic analysis.

Growing companies use accounting data to:

- Identify profitable products

- Forecast demand

- Evaluate investments

- Manage risk

- Optimize operations

Accounting thus shifts from a support function to a strategic partner in leadership decisions.

Ethics and Trust in Accounting

Accounting also carries ethical responsibility. Financial reports influence investors, employees, and communities. Accuracy and honesty are not optional; they are foundational.

Professional accountants follow codes of ethics emphasizing integrity, objectivity, confidentiality, and competence. Even small businesses benefit from ethical discipline, as trust builds reputation and stability.

Technology and the Future of Accounting

Modern accounting integrates cloud software, automation, artificial intelligence, and real-time reporting. These tools reduce manual errors and improve speed, but they do not replace understanding.

Technology handles calculations. Humans interpret results.

Those who combine accounting knowledge with digital tools gain a powerful advantage.

Conclusion

So, what is accounting in its truest sense? It is not merely about numbers or compliance. It is a structured way of understanding financial reality. Accounting records what happens, explains why it happened, and helps decide what should happen next.

For beginners, learning accounting builds confidence, control, and clarity. For businesses, it creates transparency, accountability, and direction. While accounting has limitations, its disciplined framework remains essential to responsible financial management.

By mastering the fundamentals, practicing consistently, and respecting ethical standards, anyone can use accounting not just to measure success, but to design it.

FAQs

1. Why is accounting important for beginners?

It builds financial awareness, supports better decisions, prevents errors, and helps individuals and businesses manage resources responsibly.

2. What is accounting used for in business?

Accounting is used to measure profit, control costs, prepare taxes, attract investors, and evaluate overall financial performance.

3. Is accounting only about math?

No. While math is involved, accounting mainly focuses on analysis, interpretation, organization, and communication of financial information.

4. What is the difference between bookkeeping and accounting?

Bookkeeping records transactions. Accounting analyzes, summarizes, and reports them to support decision-making.

5. Can a beginner learn accounting without a commerce background?

Yes. With basic practice and structured learning, anyone can understand accounting fundamentals.

6. What is accounting’s biggest limitation?

It relies on historical data and estimates, which may not always perfectly predict future performance.